A guide to Credit Scores in Canada

Most people don’t realize how important their credit score is until they come across a financial product they can’t obtain, due to their low credit score. Your credit score is one of the deciding factors on whether you gain approval for many financial products – think mortgages, car loans, lines of credit or personal loans. Depending on your score, your financial options may vary.

But apart from borrowing money, what else do you need a credit score for? Well, in Canada, your potential dream employer may check your credit score before offering you a job, your future landlord may perform a credit check, and if you want to rent a car for a weekend out of town, a credit score check may be a requirement. That is to say, it’s important to maintain a good credit score, because you never know what life may throw your way. In the case you need an emergency loan, credit or any kind of financing, maintaining a good credit score will ensure you will never come across any roadblocks with whatever life throws your way.

In a nutshell, a credit score shows lenders how you manage borrowed money. Your score shows them how long you’ve had credit for, the kind of credit you carry and the debt you have. A credit score also shows how much money you use, your payment history and if you have missed payments.

In Canada, these two bureaus monitor your credit: TransUnion and Equifax. Let’s dive deeper and learn more about credit scores, why they are important, and what you can do to boost your score.

This post is brought to you by Marble.ca.

What is a credit score?

Your credit score is a three-digit number that lenders use to help them decide whether or not to approve you for financing.

A good credit score is anything above 713 and excellent is between 741-900. If your score is in the 600s, or below it may be more difficult to secure a loan.

Lenders will use your score to help them decide how likely it is you will repay your potential loan or credit back on-time. Therefore, it is an important factor in your financial life. The higher the credit score, the better. Most importantly, a higher score will allow you to easily qualify for loans or credit cards at more favourable terms, such as better interest rates, helping you save money too.

If your credit score is not where you’d like it to be, you’re not alone. Improving your credit score takes time. But the sooner you address the issues that might be dragging it down, the quicker you will be able to discover how to improve it. You can increase your score by taking several steps. For instance, establishing a track record of paying bills on time, paying down debt and taking advantage of financial technology tools such as MyMarble and MyMarble Premium’s credit improvement technology Score-Up.

How can you increase your credit score?

The beauty of a credit score is that there are always ways you can improve it. Whether you’re looking for a way to boost your score a few points in order to qualify for that much-needed loan, or trying to qualify for lower interest rates, longer repayment periods on loans and better your chance of getting approved for other financial products you’re interested in, there are many things you can do to increase your credit score. Here are some tips on ways you can begin to improve your credit score to help you reach your financial goals:

Monitor Your Payment History

Your payment history is an important factor and contributes to 35% of your credit score. If you have continually missed payments in the past, and continue to do so, this will have huge impact on your credit score. Make sure to always pay your bills on time to maintain a good payment history. To help you keep track of your payment history, MyMarble allows you monitor your spending, and keep track of your debt payments to help ensure you won’t miss a payment. Find out more here.

Keep Your Credit Utilization Low

Your credit utilization rate is how much of your available credit you have used. So, for example, let’s say you have a credit limit of $1500 – it’s recommended to not have utilized more than 30% of this, which is $450. The less credit you use, the better. This shows lender that you aren’t spending beyond your means, which demonstrates that you’re managing your money effectively.

Check Your Credit Reports Regularly

You can obtain a free credit report yearly from TransUnion or Equifax, which allows you to ensure your credit report is accurate. A recent study confirmed that 79% of credit data contains errors, which could be working against you. An incorrect credit report may result in an incorrect credit score, which is why it’s important to check your report from accuracies and dispute any errors.

Utilize Credit Improvement Technology

We’re lucky to live in a world where we have access to so many opportunities online. We have the easiness of searching for answers to many of our frequently asked questions at the click of a button. We have numerous ways to keep in touch with family and friends around the world. We’re also lucky to be able to look after our financial health online, and that includes your credit score.

For example, MyMarble helps you improve your credit score and pay down debt faster, using its AI and data-driven technology. By tracking your spending, monitoring your credit score, and providing you with personalized recommendations on how to better your spending habits and budget, MyMarble will empower you to reach your financial goals. With MyMarble, you can choose a subscription plan that suits you, your goals and your budget. Depending on your plan, MyMarble will provide you with different levels of personalized recommendations on how you can improve your financial fitness.

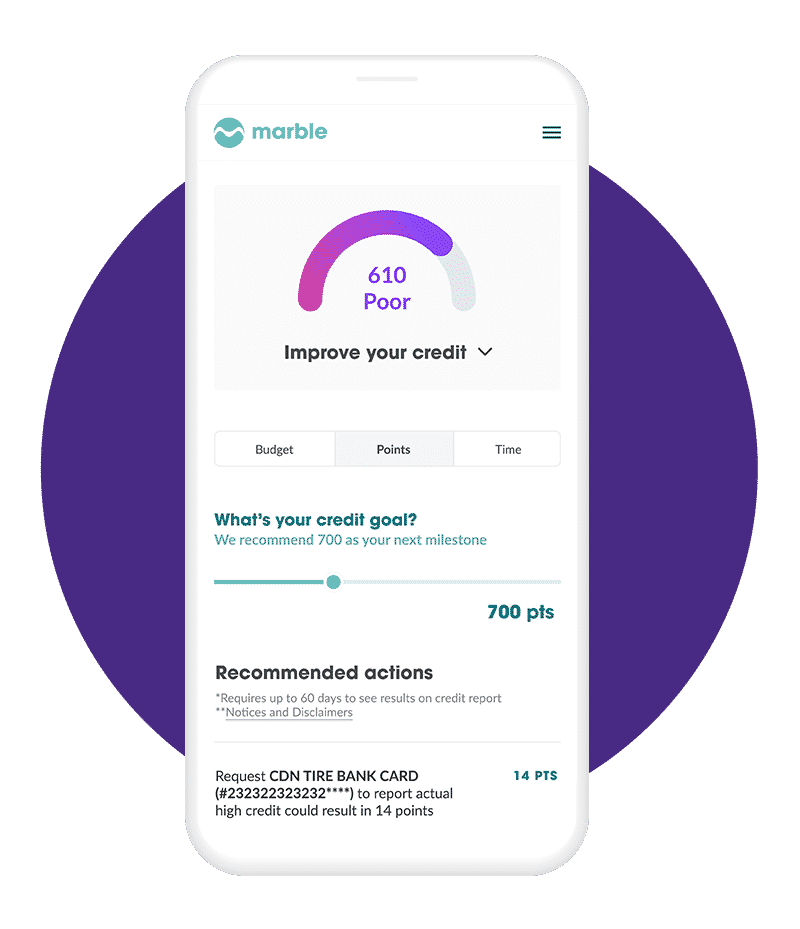

If you choose MyMarble Premium, you will be provided with access to Score-Up, our financial technology solution that will help you increase your credit score, through Point Deduction Technology ©. Our leading technology allows you to work towards your desired credit score, within your budget, by allowing you to create a target credit score based on your financial plans.

In addition, MyMarble Premium’s Score-Up provides you with access to Points and Budget Simulators. Our software analyzes your credit to create a fast and clear path to improve your credit score. For example, the Points Simulator allows you to choose your desired credit score and provides you with a clear path on exactly how you can achieve this score through recommendations. The Budget Simulator allows you to choose how much money you have left over to improve your credit score. Then, it provides you with specific tips on how you can spend that money to achieve the most credit points. In addition, Score-Up provides you with access to your credit report and allows you to track for errors and omissions.

Until April 16th, 2021, you have a chance to win $1000 from Marble.

Marble Financial has already helped thousands of Canadians get financially fit this year and to celebrate they are giving away $1000 cash to one lucky member!

Create a free account now for a chance to win $1000 and to get personalized guidance, inspiration, and innovation you need to reach optimal financial health.

- MyMarble has over 25 interactive bite-sized courses to ensure you have the core understanding for your future financial plans.

- MyMarble has the right automated tools to improve your finances to help you achieve a lower cost of credit.

- Marble is proudly Canadian helping thousands of customers improve their finances since 2015.