The Boot Camp is a 2-week online course that teaches you the basics of investing

You will learn how to:

- Get over your fears of losing money when you invest

- Create an investing portfolio that meets your goals and risk tolerance

- Confidently take control of your money so you can save fees and understand what your money is doing

I will explain to you what:

- An ETF, stock, mutual fund is, and how to buy them

- The S&P 500 and the NASDAQ is and how to invest in these indices

- A brokerage is, and how to pick an investing platform

This course is for you if:

- You’ve paid off high interest debt and have savings sitting around in an account

- You’re confused with the thought of investing

- You know you should be investing but don’t know where to start

Meet your Investing Boot Camp instructor: Liz

Liz started investing in 2009 when she was 18 years old and grew her net worth to over $500,000 by age 30.

She teaches investing fundamentals to Canadians who want to grow their wealth strategically.

Liz has been featured in:

Is the Bootcamp for you?

The content is Canadian specific. Watch this video to find out if you are a good fit for the Investing Bootcamp.

iImagine if you could

- Work less because your investments are paying you dividends

- Reach your goals earlier, like buying a house because your investments grew enough to have a down payment

- Pass down wealth to your kids because you put your money to work

The Ambitious Adulting Investing Boot camp teaches you everything I’ve learned about investing since 2009. Instead of making expensive mistakes and spending hours reading articles on investing, get everything delivered straight to your inbox.

When I started investing, I didn’t know anything about the stock market. I struggled with anxiety attacks about financial uncertainty and knew I had to take control of my finances before my anxiety got worse.

I was so scared of living paycheck to paycheck. I was so scared of being stuck at a job I hated, and broke so I started investing and learned along the way. By age 24, I had paid for my university tuition and rent, traveled to over 20 countries, and saved $54,000 after paying for all of that on my own. I used that money to buy my first property.

By age 26, I had saved and invested another $70,0000 (in 2 years!!) using index funds and individual stocks and bought a 2nd property.

By age 30, my net worth was over $500,000 and I will show you the steps I took to get there!

Is now a good time to invest?

You might be wondering…

-

Am I too old to start investing?

-

Do I have enough money to get into the stock market?

-

What if I lose all my money?

-

Where should I invest?

-

What if the stock market crashes?

The earlier you start investing, the better… but you’re not too old to start now!

If you’ve paid off high-interest debt, you can start investing with as little as $100, and with the investing strategy I will show you, it’s unlikely you will lose a lot of money. This is because index investing is less risky than options trading, individual stock picking, and crypto. The stock market as a whole is actually pretty stable, even though there is constant volatility. This chart shows you how the S&P 500 (a representation of 500 large companies in the USA) has performed overtime.

what’s included?

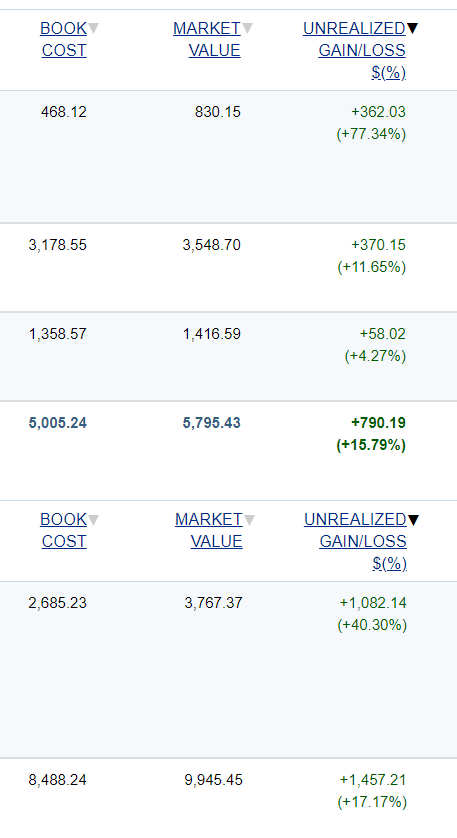

Sneak peek into my own portfolio and how my investments are performing

10+ useful templates and resources to help you understand your investing style and help you develop a strategy

20+ easy to understand videos and step-by-step guides delivered to your inbox

Here’s what you’ll learn

Investor Profile

- Risk tolerance

- Portfolio types

- Time horizons

Building your portfolio

- Picking stocks, ETFs, bonds etc.

- Asset allocation

- Understanding charts and fund facts

Logistics of investing

- Diversification

- Fees

- Brokerages (platforms to invest)

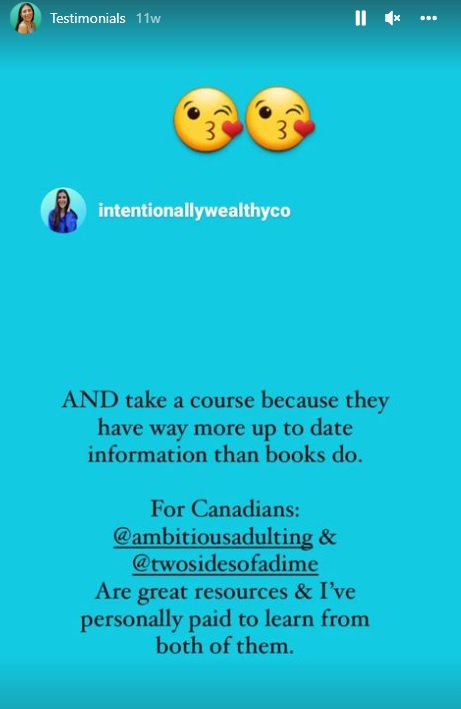

Raving reviews!

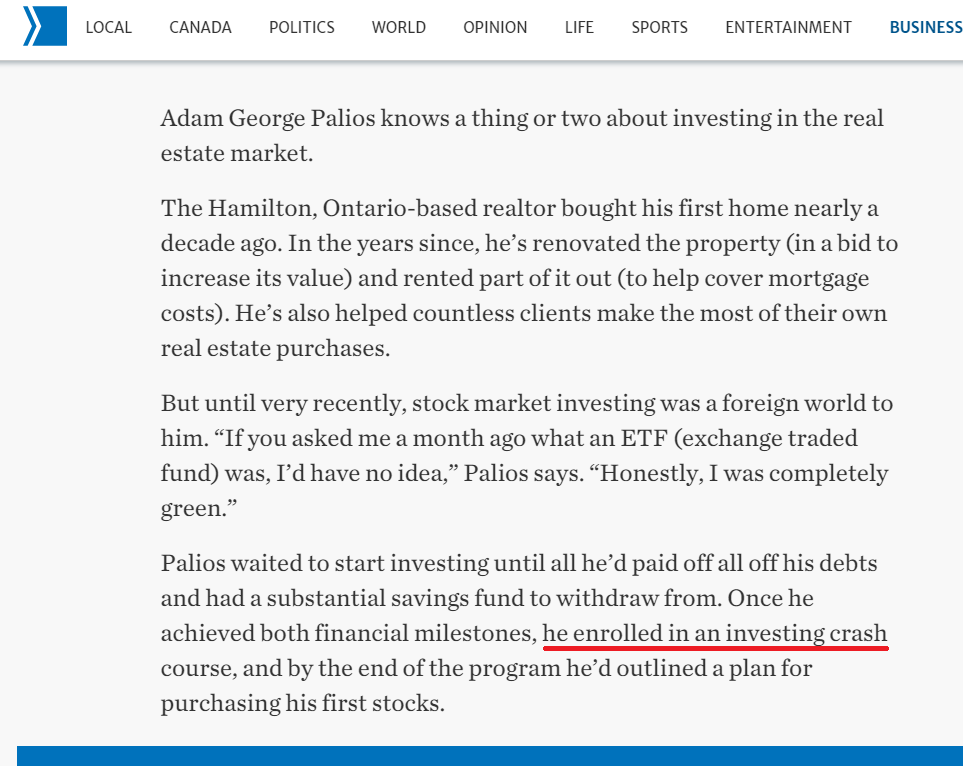

Featured in the Toronto Star on Tues., April 7, 2020

FREQUENTLY ASKED QUESTIONS

What's included in the course?

Will you tell me which investments to buy?

What if I lose money investing?

What sets this course apart?

This self-paced course is available on-demand. You can sign up now and learn about investing on your own by following a step-by-step tutorial system that walks you through the basics of investing.

The self-paced 2-week program is

Only $290+HST CND

have more questions?

Want one-on-one help? Book a clarity session with me

BONUSES

unlimited DM support ($300 VALUE)

Investing Bootcamp members can send me voice notes and messages with questions about investing and you WILL recieve a respond within 24 hrs. Due to the volume of messages I get, I don’t always respond to messages but Ambitious students jump the line and get priority.

Lifetime access!

The course is meant to be completed in 2 weeks so you can JUMP in and start investing. However, you have lifetime access to the content.

Sneak peak

See what I am buying and how my investments are performing in real time

BONUS:

Get the ethical investing workshop $65 value (learn how to create a socially responsible porfolio that fits with your values)